India’s manufacturing output growth slipped to a two-year low in December, weighed down by softer demand conditions and a slowdown in export orders, according to an industry survey released by S&P Global on Friday.The Purchasing Managers’ Index (PMI) for manufacturing eased to 55 in December from 56.6 in November, marking a sharp decline from a near five-year high of 59.2 recorded in October. A PMI reading above 50 indicates expansion, while a level below 50 signals contraction. Despite the moderation, manufacturing activity continued to remain in expansionary territory, with output still rising.

S&P Global noted that growth in manufacturing output during December was the weakest since October 2022, underscoring a gradual loss of momentum towards the end of the year.

“Even with growth momentum easing, India’s manufacturing industry wrapped up 2025 in good shape,” said Pollyanna De Lima, Economics Associate Director at S&P Global Market Intelligence. She added that a strong rise in new business intakes could support activity in the final quarter of the fiscal year, while subdued inflationary pressures may help underpin demand.

Part of the slowdown in overall sales stemmed from a softer expansion in international demand. New export orders increased at the slowest pace in 14 months. Where growth was reported, firms cited improved demand from clients in Asia, Europe and the Middle East. However, De Lima pointed out that the share of companies reporting higher export sales in December was about half the average seen during 2025, reflecting a sustained period of weaker export momentum.Labour market conditions also showed signs of cooling. The pace of job creation in December was the lowest since March 2024. Although outstanding business volumes rose, the rate of accumulation was marginal, with the relevant seasonally adjusted index hovering close to the no-change mark of 50.

Inventory trends mirrored the moderation in activity. Stocks of purchases rose at the slowest pace in two years, amid a softer increase in buying and the use of materials to support production.On the cost front, manufacturers reported another increase in input prices, attributed to higher costs of bamboo, chemicals, glass, leather and packaging materials. However, the rate of inflation was little changed from November, remained below its long-run average, and was among the lowest recorded in 2025. Output price inflation also softened, registering its weakest pace in nine months.

Business sentiment weakened further, falling to its lowest level in nearly three-and-a-half years. While firms cited advertising efforts, positive demand trends and new product launches as supportive factors, concerns persisted over competitive pressures and broader market uncertainty, S&P Global said.

(Business Correspondent)

.jpg)

Ira Singh

Ira Singh

Related Items

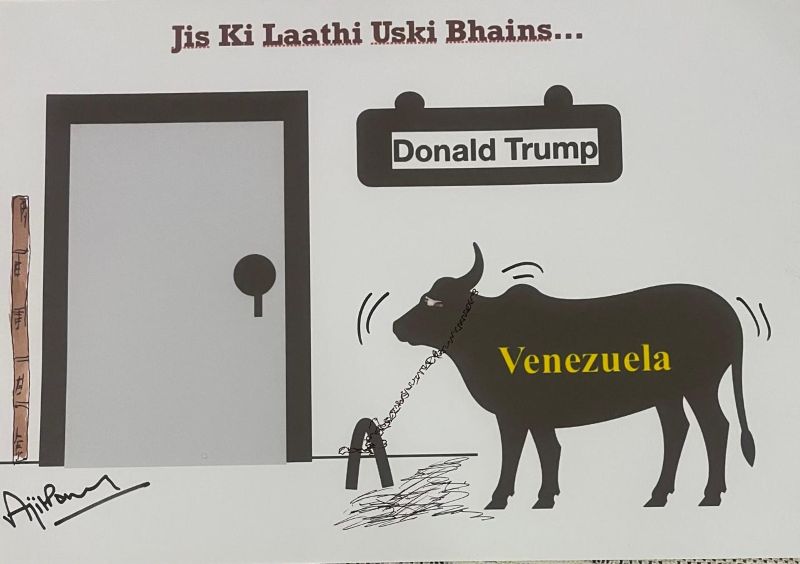

Not accurate: India after Trump aide's remarks on trade deal

Modi didn't call, Trump aide explains why India-US trade deal derailed

India to launch cashless treatment for victims of road accidents