As India approaches another Union Budget, the familiar cycle of anticipation and scepticism returns. Pre-Budget consultations, sectoral roundtables, policy hints, and ministerial statements once again create the impression of a government in constant motion. Headlines speak of ambition, reform, and record allocations. Yet beneath the spectacle lies a persistent and uncomfortable question: does the Budget still function as a genuine instrument of democratic fiscal governance, or has it increasingly become an exercise in optics and narrative management?

Over the past decade, a pattern has emerged—one marked by expansive announcements, restrained fund releases, delayed execution, and diminishing parliamentary scrutiny. Whether Budget 2026 will break this pattern or merely refine it remains to be seen.

Pre-Budget Showmanship and Public Perception

Each year, ministries engage with industry bodies, experts, and civil society in pre-Budget consultations. In principle, these interactions are valuable. In practice, they also serve a signalling function. Media coverage amplifies selective cues about sectoral priorities, while social media and press briefings reinforce the message that the government is actively shaping the economy’s future.

However, the visibility of these exercises often contrasts sharply with outcomes. The repeated emphasis on intent and allocation obscures a critical metric: actual expenditure. Ministries may announce large outlays, but utilisation frequently lags. The result is a widening gap between perception and delivery—between what is promised and what reaches citizens.

Headline Schemes, Patchy Execution

Flagship programmes illustrate this disconnect clearly. The Skill India initiative, launched with the promise of equipping millions of young Indians with employable skills, was widely celebrated. Yet subsequent audits and independent assessments pointed to uneven implementation—underutilised training infrastructure, weak placement outcomes in some regions, and governance lapses including inflated or unverifiable beneficiary figures.

This is not an isolated case. Rather, it reflects a recurring governance pattern: high-profile launches generate political capital, while the complexities of implementation receive far less sustained attention. Political credit is centralised, but administrative responsibility and execution risks are diffused.

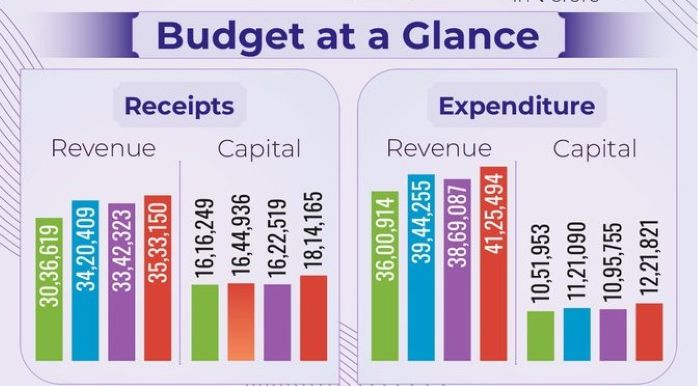

Allocations Versus Absorption

Public expenditure data consistently show that several ministries spend only a portion of their approved allocations. Procedural bottlenecks, delayed approvals, phased releases, and tight cash-flow controls slow the movement of funds. While headline numbers convey ambition, the lived reality is incremental delivery.

This approach allows the government to balance competing objectives: projecting fiscal activism while maintaining aggregate fiscal discipline. Underspending is increasingly framed as prudence rather than as a signal of administrative constraint or limited absorption capacity. The optics of responsibility are preserved, even as outcomes remain modest.

The Quiet Disappearance of Parliamentary Scrutiny

Traditionally, shortfalls between budgeted and actual expenditure led ministries to seek supplementary demands for grants. These debates were an important mechanism for parliamentary oversight, allowing legislators to interrogate implementation delays, re-prioritisation, and delivery timelines.

In recent years, this practice has largely faded. Ministries rarely seek substantial supplementary allocations, even when spending lags significantly. Tight expenditure control and phased releases have rendered supplementary debates almost redundant. As a result, underspending no longer triggers parliamentary scrutiny; it has become an administrative feature of the system.

This shift subtly but materially weakens Parliament’s role in fiscal oversight.

Erosion of Budgetary Sanctity and Parliamentary Authority

Beyond execution gaps lies a deeper institutional concern: the gradual erosion of the Union Budget’s constitutional sanctity and Parliament’s authority over fiscal decisions.

In recent years, major tax and revenue measures have increasingly been announced outside the Budget framework and without prior parliamentary deliberation. The Union Budget, historically the principal forum for debating taxation, expenditure, and borrowing, risks being reduced to a post-facto ratification of executive decisions.

A striking illustration is the Prime Minister’s public announcement of a substantial reduction in GST rates, described as a “Diwali gift” amounting to nearly ₹2.5 lakh crore. While GST rates are formally determined by the GST Council, a revenue sacrifice of this magnitude has direct implications for the Union’s fiscal balance. Yet the announcement raised fundamental questions that were not addressed in Parliament at the time: how would the resulting shortfall be accommodated within fiscal deficit targets? Which expenditures would be curtailed, deferred, or financed through borrowing? When such decisions are communicated as political gestures rather than presented within the Budget, legislative scrutiny is diluted.

A similar issue arises with revenue-enhancing measures. The recent announcement of a tariff hike on tobacco, scheduled to take effect on the very day the Budget is tabled, effectively pre-empts parliamentary debate. If key taxation decisions are finalised before the Finance Minister rises to present the Budget, Parliament’s role risks being reduced to confirmation rather than deliberation. Over time, this fosters a fait accompli culture in fiscal governance.

The cumulative effect of these practices is significant. Fiscal policy increasingly migrates from Parliament to podiums and press releases. The Budget remains central in form, but its deliberative substance is fragmented.

Centre–State Dynamics and Cash-Flow Control

Part of the persistent gap between promise and delivery lies in how funds are released. The Centre exercises tight control over cash flows, balancing fiscal targets against programme priorities. In practice, this often results in delayed or staggered releases to states.

Schemes in opposition-ruled states frequently experience slower disbursement, justified on procedural grounds. Whatever the intent, the outcome is uneven absorption and delayed benefits for citizens. Headline allocations thus fail to translate into uniform delivery, reinforcing scepticism about Budget promises.

Budget Optics and Market Signalling

Pre-Budget announcements also shape financial market sentiment. Hints of sectoral emphasis or flagship spending can influence investor expectations, sometimes even before allocations are finalised. While there is no evidence of deliberate manipulation, the signalling effect is undeniable.

In this sense, the Budget increasingly functions as a narrative and market signal, not merely as a spending instrument. Optics and perception begin to rival actual cash flows in determining impact.

Social Spending: The Silent Adjustment

The procedural and institutional shifts described above have tangible consequences. When headline tax cuts, selective tariff changes, and politically visible announcements dominate the fiscal narrative, adjustments are often absorbed through muted or delayed spending in less visible but critical sectors—education, health, nutrition, and rural infrastructure.

These areas lack the immediacy of political signalling but are essential for long-term social and economic resilience. Their relative neglect is not accidental; it is structurally linked to a governance approach that prioritises executive visibility over sustained delivery and parliamentary consent.

Continuity or Change?

The evidence of the past decade points to continuity rather than rupture: expansive announcements, constrained execution, selective fund release, diminishing supplementary debates, and a gradual dilution of Parliament’s fiscal role.

Unless reforms strengthen parliamentary oversight, restore the Budget’s deliberative centrality, and address the mechanics of cash release and state-level absorption, Budget 2026 is likely to follow the same trajectory. It may look impressive from afar, but its impact will arrive slowly, unevenly, and often below promise.

In that sense, the real challenge before the Budget is not one of numbers alone, but of institutional credibility. A Budget that commands trust must not only announce ambition—it must respect process, invite scrutiny, and deliver visibly where citizens feel it most.

(Views are personal) (The writer is a retired officer of the Indian Information Service and a former Editor-in-Charge of DD News and AIR News (Akashvani), India’s national broadcasters, as well as Media-link Information Officer of Press Information Bureau (PIB) attached to various ministries. He has also worked as an international media consultant with UNICEF Nigeria and contributes regularly to various publications in India and abroad)

.jpg)

Krishan Gopal Sharma

Krishan Gopal Sharma

Related Items

Governor highlights Bihar’s development as Budget session begins

Markets rebound after Budget selloff; Sensex up 944 pts

Kerala Oppn MPs protest Union Budget, call it ‘Anti-Kerala Budget’