The domestic share market indices bounced back on Monday, closing higher and partially offsetting Budget-related losses, as Nifty finished close to 25,100.At close, the Sensex was up 943.52 points or 1.17 percent at 81,666.46, and the Nifty was up 262.95 points or 1.06 percent at 25,088.40

Tata Motors Passenger Vehicles, Tata Consumer, Adani Ports, Power Grid, Bharat Electronics were the top gainers on the Nifty, while losers included Shriram Finance, Max Healthcare, Cipla, Axis Bank, Infosys.On the sectoral front, FMCG, metal, oil & gas, energy, infra, realty jumped 1-2%, while IT index shed 0.5%.Nifty midcap index rose 1%, while smallcap index added 0.6%.

Rupee Close:

On 2 Feb'26, the Indian rupee gained 42 paise to close at 91.51 against the U.S. dollar on Monday, a day after the Union Budget 2026-27 was presented, largely as crude oil prices retreated from their elevated levels.Forex traders said the Reserve Bank of India (RBI) seemed to be defending the 92 per dollar level with a lot of resolve.

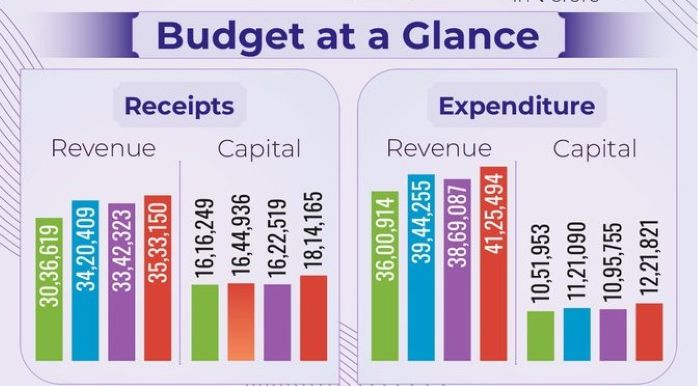

For the rupee, the Budget offered reassurance, not relief, and the government's high borrowing plan is likely to weigh on investor sentiments going ahead.The government is likely to borrow ₹17.2 lakh crore in the next financial year to fund its fiscal deficit projected at 4.3% of the GDP."Overall, it looks like a prudent budget, focusing on continuity. Given the geopolitical uncertainties and challenges, it seems the government it seems has chosen to go a bit slow on fiscal consolidation," IFA Global said in a research note.

Trading Guide:

Vinod Nair, Head of Research, Geojit Investments stated,the market witnessed a smart recovery following yesterday’s volatile session due to the impact of the STT hike on F&O and the government’s higher borrowing plan for FY27. At the same time, the Budget’s policy continuity with a clear emphasis on growth and fiscal prudence has helped reinforce confidence in the medium to long term earnings outlook.A sharp decline in global crude oil prices has also offered some relief, reflecting signs of easing geopolitical tensions between the US and Iran. Nevertheless, in the near term, market mood is expected to stay cautious due to below estimate Q3 earnings and ongoing global tensions.

Market experts have recommended eight stocks to buy on Monday — Medanta, Netweb Technologies, Wipro, TCS, Max Health, Kaynes Technology, Ather Energy, Aster DM Healthcare.

(Business Correspondent)

.jpg)

Ira Singh

Ira Singh

Related Items

Markets slide on Budget jitters; Sensex fall 1,547, Nifty Below 24,850

Market snaps 3 day winning run, Nifty below 25,350 ahead of Budget'26

Nifty reclaims 25400, Sensex up 222 pts in a volatile session