The Union Budget 2026–27 has been presented at a moment when the global economic and political environment remains deeply unsettled. Wars continue to disrupt trade routes, financial markets remain sensitive to interest rate movements in advanced economies, and supply chains are increasingly shaped by geopolitics rather than efficiency alone. For an economy like India—integrated with global capital markets yet still addressing domestic development imperatives—this context matters as much as the numbers themselves.

Against this backdrop, the Budget is best understood as a continuity and consolidation Budget. It is neither flamboyant nor populist. It avoids dramatic departures and resists the temptation of short-term giveaways. Instead, it reflects confidence in the broad stability of the Indian economy and a deliberate decision to stay the course.

That choice, in today’s circumstances, is itself significant.

Fiscal discipline as a structural imperative

Perhaps the most important signal comes from the fiscal stance. The fiscal deficit for FY 2026–27 has been pegged at 4.3 per cent of GDP, marginally better than the previous year. This improvement may appear modest, but its significance is substantial.

Fiscal discipline today is no longer merely a matter of political intent; it has become a structural constraint. India’s government bonds are now part of global indices. International investors track fiscal numbers closely. Any slippage would immediately reflect in borrowing costs, interest rates, and ultimately in the cost of capital across the economy—from infrastructure projects to housing loans.

By choosing restraint even in a politically sensitive period, the Budget underscores that credibility with markets and lenders is being prioritised over short-term populism. In an era of volatile capital flows, credibility is not an abstract virtue; it is an economic asset.

No fresh tax concessions—and the logic behind it

There were, unsurprisingly, no sweeping reductions in either direct or indirect taxes. While this may disappoint some expectations, it reflects sound economic reasoning. Tax collections—both income tax and GST—are projected to grow at a slightly more moderate pace. In such a situation, additional concessions would either widen the deficit or force spending cuts elsewhere.

Instead, the Budget focuses on tax simplification rather than tax reduction: a new Income Tax Act to come into effect from April 2026, rationalisation of penalties and prosecutions, streamlined compliance, and relief in specific hardship cases. These measures reduce friction without undermining revenue.

This approach recognises a basic but often overlooked truth: aggressive tax cuts without corresponding expenditure restraint tend to raise borrowing, push up interest rates, and ultimately dampen growth. Prudence here is not ideological—it is practical.

Capital expenditure remains the main growth engine

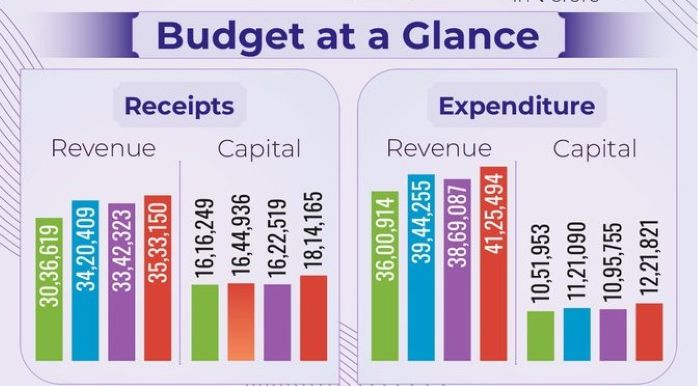

Public capital expenditure has been raised from ₹11.2 lakh crore to ₹12.2 lakh crore, reaffirming that infrastructure-led growth is no longer a temporary stimulus strategy but the core economic model.

Capex performs a triple function: it creates productive assets, lowers transaction and logistics costs, and crowds in private investment. It may be slow and unglamorous, but it is structurally powerful. The government’s consistent commitment to capex reflects an understanding that durable growth depends less on consumption spurts and more on capacity creation.

The announcement of seven high-speed rail corridors, described as “growth connectors”, illustrates a maturing infrastructure philosophy. This is not merely about construction activity; it is about integrating labour markets, reducing travel times between industrial clusters, and increasing economic density. Infrastructure policy is moving from asset creation to regional integration.

Manufacturing as a strategic capability

Across announcements on semiconductors, electronics, biopharma, textiles, and advanced manufacturing, a clear theme emerges: manufacturing is being treated not as a cyclical sector but as a strategic capability.

Initiatives such as Semiconductor Mission 2.0, tax holidays for data centres till 2047, customs duty exemptions for capital goods used in lithium-ion batteries and critical minerals, and the ₹10,000 crore BioPharma Shakti programme point to a long-term industrial vision.

Manufacturing matters because it creates large-scale employment, supports exports, and stabilises the currency. Services stabilise the economy; manufacturing transforms it. The Budget reflects that distinction clearly.

Rare earths, critical minerals, and supply chain realism

One of the least flashy but most consequential moves is the focus on rare earths and critical minerals. In a world where supply chains are increasingly weaponised, access to minerals such as lithium, nickel, and rare earth elements is no longer a technical issue—it is a strategic one.

By treating mining, processing, and mineral logistics as national economic infrastructure, the government is acknowledging a key constraint that has long limited manufacturing ambitions. This is not about extracting more; it is about owning value chains, particularly the midstream segments where strategic leverage lies.

MSMEs: from survival to scale

The proposed ₹10,000 crore MSME Growth Fund signals a shift in MSME policy—from survival to scale. Along with liquidity support and compliance rationalisation, the emphasis is now on equity, governance, and integration into larger supply chains.

This marks a move away from protection towards productivity. Supporting MSMEs as future champions rather than perpetual dependents is a welcome evolution.

Stability as strategy

There are no headline-grabbing reforms in this Budget. Instead, there are process reforms: simplified compliance, clearer rules, predictable policies. These may not excite markets overnight, but they matter deeply to businesses and investors planning over decades.

Taken together, the Budget rests on a simple but coherent logic: stability enables investment; investment builds capacity; capacity reinforces credibility.

Taken as a whole, the Budget follows a clear and disciplined logic: stability enables investment, investment builds capacity, and capacity underwrites credibility. In a world marked by geopolitical fractures, volatile capital flows, and economic uncertainty, credibility is not an abstract virtue; it directly shapes borrowing costs, investment decisions, and growth prospects. By choosing consolidation over spectacle and discipline over short-term populism, the Budget signals how India intends to navigate this moment. It may not generate instant applause, but it strengthens the foundations on which durable growth must rest.

(Uday Kumar Varma is an IAS officer. Retired as Secretary, Ministry of Information & Broadcasting)

.jpg)

Uday Kumar Varma

Uday Kumar Varma

Related Items

Governor highlights Bihar’s development as Budget session begins

Markets rebound after Budget selloff; Sensex up 944 pts

Kerala Oppn MPs protest Union Budget, call it ‘Anti-Kerala Budget’