Fuel prices are steadily increasing to historic highs due to surge in international crude oil prices. Now it stood at ever high of Rs 100. Diesel at 90. There is no respite from daily upward trend of about 50 paise average since last fortnight. It may further surge above 66 dollars. Taxes levied by central government and state government make up for more than 60% of the retail selling price. Union finance minister Nirmal Sitharaman has described it as ' maha bhayankara dharma sankata'. She referred the steep increase in fuel prices to different aspects involved in pricing. Government has not applied its mind as to how to reduce the burden on the common man. No answer except bringing down the prices will convince anyone.

Opposition congress raps the government over spiralling prices and organising protest rallies all over the country. Congress president Sonia Gandhi has repeatedly accused prime minister Narendra Modi for choosing to profiteer off people's misery and demanded roll back excise duty on fuels partially. It is the duty of any government to ease the burden of common man. But there no such signs can be seen. Opposition claims that crude prices have marginally increased but duty on fuel is exorbitant compared to their UPA regime.

Reserve Bank of India has urged both the central government and state governments to reduce indirect taxes on fuel. By this, inflation will go up, they directly affect as common man has to pay for it and invariably prices of all the essential commodities will go up. Government has to encourage the use of other non conventional sources like solar and electric power in a big way. Electric vehicles have to be highly subsidised. As of now, government has not done anything specifically to promote electric vehicles. In Bengaluru alone Bescom has 70 recharge stations, but there are only few takers for it. The government should provide financial incentives and low interest loans to buy electric vehicles as it is the only mode of future.

In Bengaluru, petrol pumps have fixed a minimum of Rs 50 to fill the tank. Many small bike owners are unable to fill their bikes with less amount. Auto rickshaws, luggage vans, taxis are charging heavily to offset their losses. In rural areas tractors and jcb's, tempos have hiked the rent making people's life miserable. This has lead to price rise of food grains, vegetables and fruits.

It is the responsibility of both state and central governments to sit together and find a permanent solution for this vexatious issue. Now both state and central governments are generating heavy revenue. If oil producing countries cuts the production, then there will be further pressure on fuel prices. As the petroleum prices are freed, the oil companies would not take any decision to reduce prices which goes against their interest. Petrol prices are now not guided by GST. There is urgency to bring them under GST for which state governments will not agree. This duel taxing has to be stopped and one nation one tax policy is immediate requirement. Although four states have reduced little tax, but it is insignificant. As oil is on boiling, governments need to decrease fuel taxes before economic activity is harmed.

.jpg)

Dr Mysi Patil

Dr Mysi Patil

Related Items

Govt aims to increase pulses production by 40%: Shivraj Singh

Oil prices gain 1% after OPEC+ agree to boost production

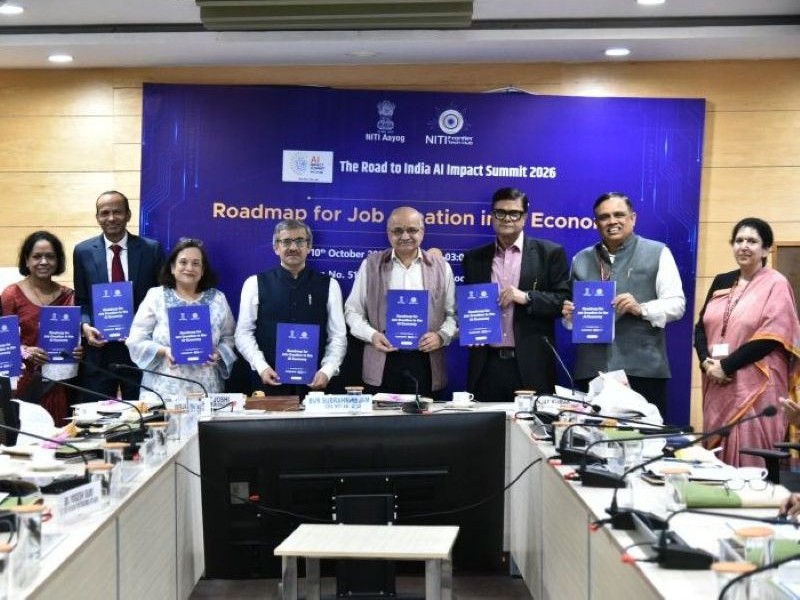

GST changes to increase GDP by nearly Rs20 lakh crore: Vaishnaw